Corporate Partnerships

We partner with firms, institutions and industry innovators looking to bring blockchain-based solutions to their businesses.

Corporate Services

Advisory for Product Structuring

At Gen. M Partners, we specialize in offering advisory services on product structuring tailored for forward-thinking firms, institutions, and industry innovators keen on integrating blockchain-based solutions into their businesses.

Corporate Asset Management

At Gen. M Partners, we adopt a forward-looking strategy in corporate treasury management. Tailoring our approach to each client's unique risk profile, we aim to steer companies toward achieving optimal capital efficiency and revenue security. Additionally, we assist in treasury preservation and growth strategies.

Why Tokenize Securities?

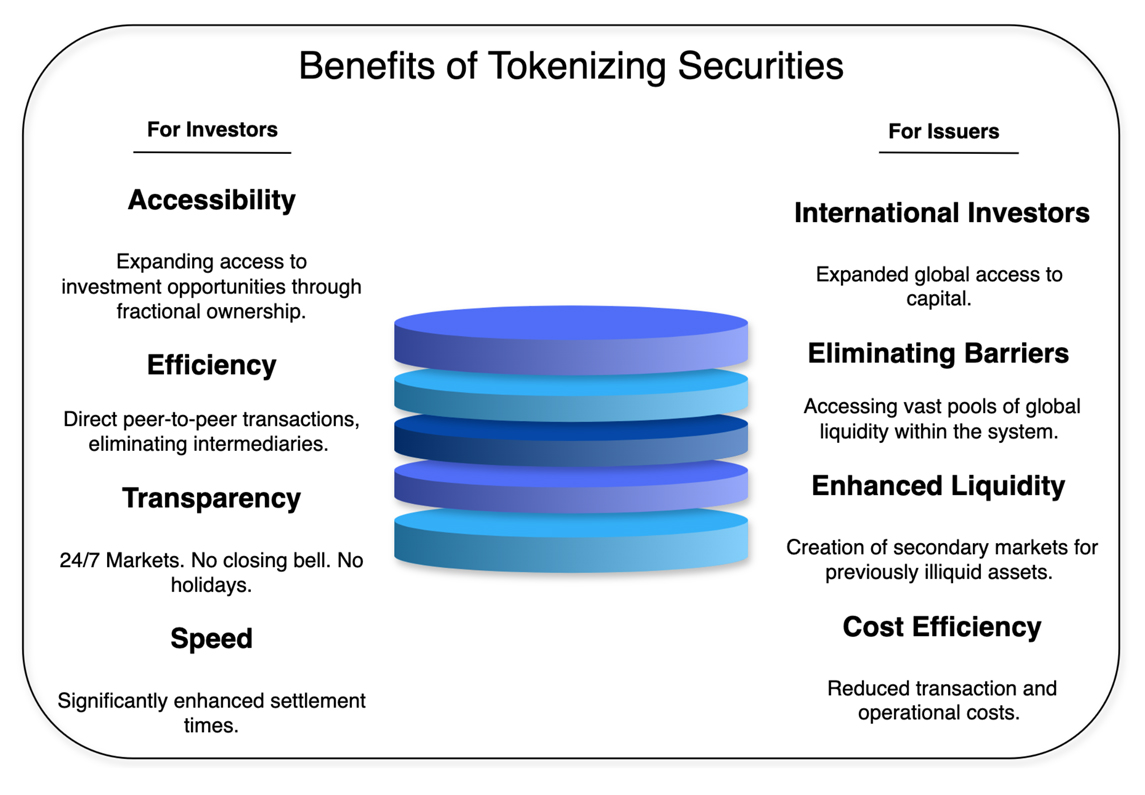

The transformative potential of tokenizing securities, financial instruments, and any other asset class cannot be overstated, particularly within capital markets.

Security tokens are poised to fundamentally reshape traditional finance, unlocking the value of trillions of dollars tied up in illiquid assets, facilitating the raising of fresh capital, and ushering in innovative secondary markets.

Tokens could represent everything of value - physical goods, real estate, Intellectual Property (patents, trademarks, etc.), Commodities, securities, funds and a lot more.

How does the Tokenization of Real World Assets Work?

How do we ensure that RWAs are legitimate tokens of the real-world assets they are representing? The entire process can be broken down into three phases:

Step 1

Off-Chain Formalization: Before an RWA can be integrated into a DLT, its value, ownership and legal standing must be unequivocally established in the physical world.

Step 2

Information Bridging (Tokenization Process): The asset's information is turned into a digital token. Data about the asset’s value and rightful ownership are embedded within the token’s metadata.

Step 3

RWA Protocol Supply & Demand: They help bring new RWAs into existence, which means they help make more of these digital assets available, they also work to get investors interested in buying and trading these assets.

Through this three-phased approach, RWAs are not merely abstract concepts but become practical, functional and critical components of the DeFi landscape, carrying the weight and trust of real-world valuation and legal frameworks into the digital asset space.

Considering Capital Raising On-Chain? Gen. M Partners can help you with the entire process.

Blockchain technology can offer several advantages when it comes to raising capital.

Fractionalization: Assets can be divided into smaller parts, making them more accessible to a wider range of investors.

Lower Barriers: Blockchain can help to reduce the barriers to entry for both companies and investors.

Trading: Security tokens can be easily traded on secondary markets, providing investors with liquidity.

Transparency: Blockchain provides a transparent and immutable record of all transactions.

Through this three-phased approach, RWAs are not merely abstract concepts but become practical, functional and critical components of the DeFi landscape, carrying the weight and trust of real-world valuation and legal frameworks into the digital asset space.

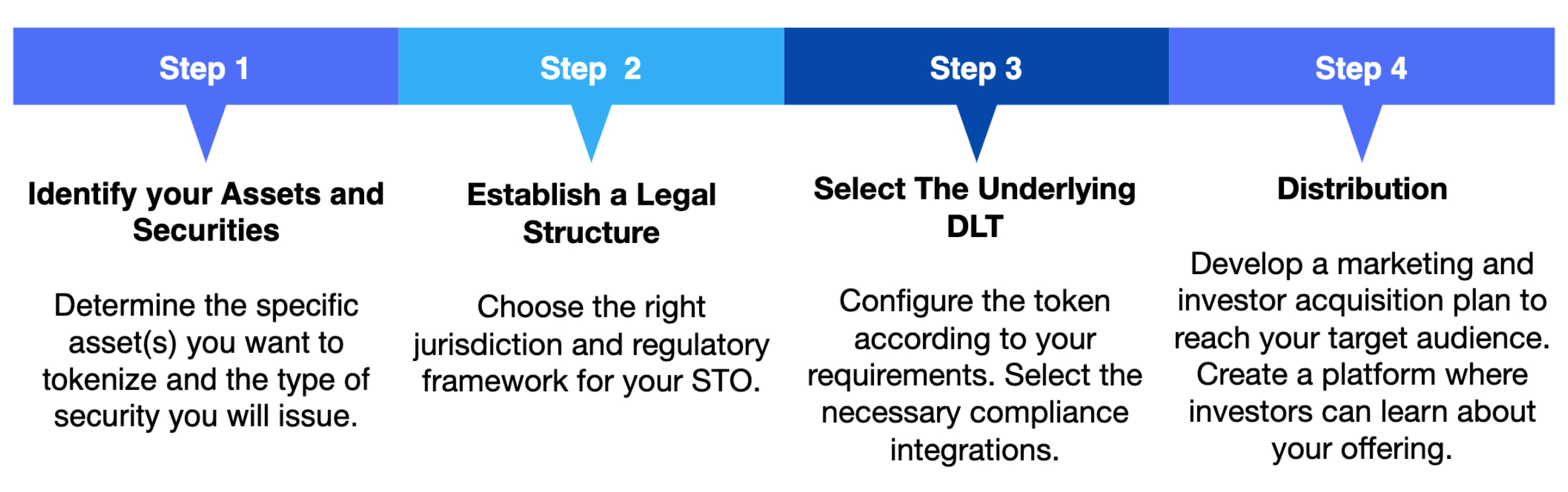

The Security Token Offering Process